Wealth & Asset (W/A) Management is a sector with greater growth prospects and lower capital requirements than many other financial sectors, offering an enormous opportunity for those willing to innovate and stay ahead of the curve within the industry. The marketplace has long been a fragmented one, and a range of different professionals often work together to meet the needs of each individual client.

Providers within the sector offer a diverse suite of services to a broad range of clients, with some W/A management firms specialising in serving institutions, while some focus on individuals. Asset Managers are responsible for making, monitoring and managing investments, creating investment funds, providing independent financial advice, and sourcing appropriate investments for their clients.

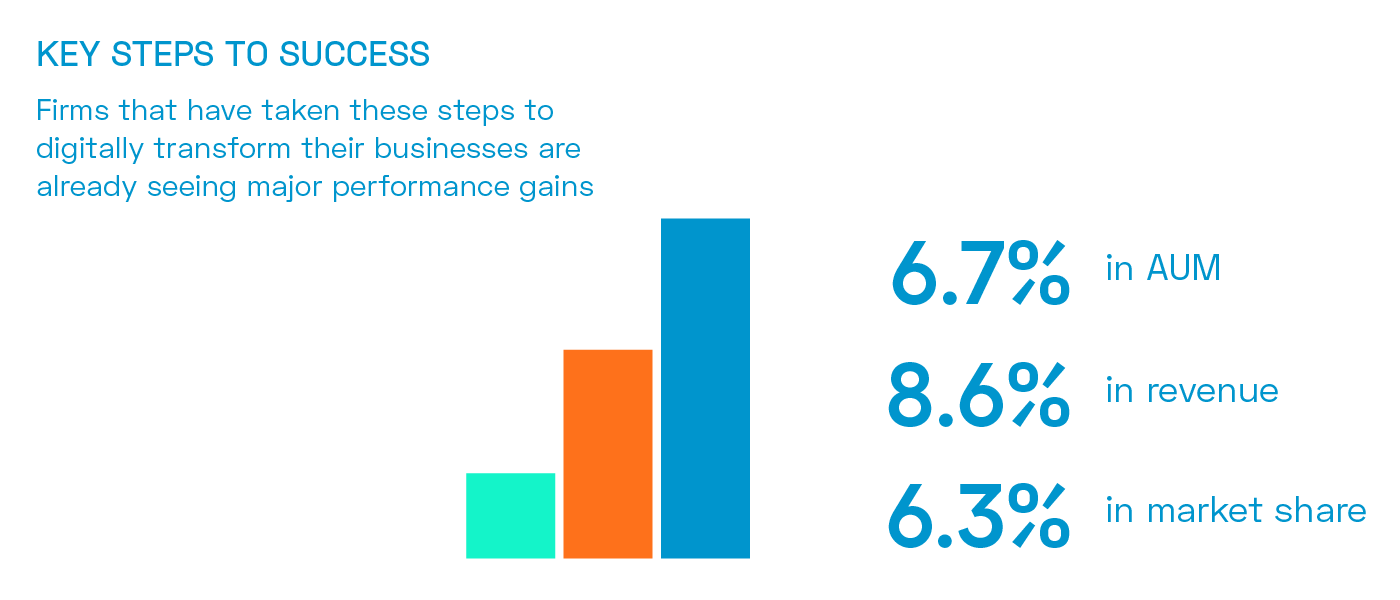

The complex nature of the industry means digitisation could be highly beneficial for W/A Management firms, but its adoption has been slow. This is surprising, given that the opportunities to take advantage of digital technology span every area of the sector. Digitisation can be used to increase sales, optimise operational efficiency, build customer profiles, and provide a more complete and proactive service. Customers can see real-time performance of their investments enabling a new type of relationship with your organisation.

As is always the case with firms operating within the financial sector, one vital issue for asset management companies is compliance. Addressing the complicated compliance issues within the financial sector can only be made easier as firms take the steps to convert to digital solutions. Compliance is a broad issue that can seem overly complex, not least because it is subject to frequent changes. However, compliance issues can be factored into digital solutions in various ways, allowing firms to deal with GDPR rules and changing FCA regulations, as well as other evolving legislations, as detailed below.

While there is some crossover, the sub-verticals within W/A Management can be clearly defined, with each sub-vertical serving a slightly different group of customers.

IFAs, or Independent Financial Advisors, create financial plans and advise clients on a wide range of financial products and services. They act much like a retail outlet that provides information and advice on various products that may be of use to customers. They often liaise with other professionals within the industry to best serve their clients’ needs.

Wealth Managers sometimes offer their own products, including pensions, health and life insurance, and investment products. They offer services such as estate planning, accounting, tax services, and retirement planning to high net worth individuals, and some may incorporate an investment management division.

Investment Managers are engaged by and work hand-in-hand with IFAs or Wealth Managers, offering a specialist service that tends to cater predominantly to high net worth individuals or organisations. Unsurprisingly, they focus on investing their clients’ wealth and managing those investments according to objectives and parameters defined by the client.

Fund Managers create and manage funds based on a specific industry, geographic area or theme. They may create regional funds, ethical funds, or high-risk funds to cater to a range of customers. They are responsible for researching the market, making trading decisions and actively implementing those decisions on behalf of all the individuals or organisations that have invested in that fund.

Crowdfunding involves an internet-based investing platform that gives access to a diverse group of investors, usually with very low barriers to investment. Crowdfunding allows investors to buy shares in small, fast-growing companies that are not yet publicly listed.

360 Service Providers offer all of the above under one roof, offering a one-stop shop for a broad range of investors.

The W/A Management space involves many providers offering a range of complementary services or working in partnership with others to provide a more flexible and comprehensive service to clients. It is not unusual for IFAs to work within other organisations such as accountancy firms, and while IFAs do not offer their own financial products, each will have their own ‘go-to’ investment managers , funds and other partner managers whose products they will recommend to clients.

In addition, many professionals working within the W/A Management industry will have their preferred platforms that can be used to group together investments and other financial products for reporting purposes. Often, their clients can be given access to these platforms as well, to directly access details of those investments.

Clearly, a move towards a digital platform that caters for W/A customer management processes can simplify much of the above. Digital W/A Management systems can facilitate easy collaboration and partnerships, instant multi-way communication, central workflow management, and comprehensive and easily accessed reporting. Centralising all of this data to have a single source of trust and single view of the customer in real-time is key, enabling data-driven decisions.

Source : Forbes

Identification & authentication

Monitor, alert & terminate

Separation of duties

Report on access, checkouts, sessions & use of privilege

Accountability

Indexed & searchable database of session activity

Access control / authorization

Session auditing & video capture

Establish granular security controls

Audit everything

Compliance issues that firms need to be constantly mindful of include anti-money laundering (AML) checks, which are carried out as standard at all investment firms and must be reported to the FCA, as well as Know Your Customer (KYC) checks. KYC checks involve verifying that each new customer is exactly who they claim to be, which of course, involves collecting and processing personal and potentially sensitive data on each customer.

One vital aspect that applies to every sub-vertical within W/A Management is data processing.

Every organisation in this space is subject to certain regulations, such as GDPR , which can be complex enough in itself. Furthermore, the majority of UK organisations will also be subject to regulation from the Financial Conduct Authority (FCA). FCA reporting and compliance can be challenging, complicated and expensive for smaller firms, which is one of the reasons why there is so much consolidation and subsequently SMBs don’t always reach their full potential.

Data security is, of course, a further area governed by strict compliance regulations, with complex rules covering the collection, storage and use of such data. Frequent changes are a constant challenge for W/A Management firms, with evolving legislations that need to be monitored so their implications can quickly be assessed and applied to the relevant areas of the business. Therefore, there is a need for due diligence to be in place to constantly assess potential risks and ensure ongoing compliance.

In addition to this, establishing the profile of a private client is key to providing an ethical and compliant range of services for them. It is vital for firms to distinguish between sophisticated and non-sophisticated buyers . Sophisticated buyers are those with high net worth and a high level of experience in the industry who will have access to a much wider range of investments. A non-sophisticated investor does not have expert knowledge of the market, may not have a lot of capital to invest and needs more support and guidance from professionals. This type of client will typically need to go to an IFA to get access to certain investments, so it is vital that IFAs are able to meet the full range of compliance issues that may apply to them, given the products they are offering and the types of clients they advise.

Source : World Health Report

Sustainable

Investing

Gaining mainstream momentum and redefining asset management history

Firms must reinvent their offerings and the way customer relationships are managed

Intergenerational

wealth transfer

omnichannel

offerings

Essential for seamless customer engagement

Key differentiator for wealth management firms in the new era

hyper-personalized

services

Analyzing client emotions to create highly-customized offerings

AI to enhance advisor effectiveness and improve client satisfaction

Cybersecurity remains a concern amid apprehension about increase in cyber attacks

AI eases unwieldy client onboarding KYC processes, reduces costs, provides better customer experience

Open APIs to foster innovation and create new channels of growth

Source : World Health Report

The W/A management sector is highly relationship-driven. When customers are planning to hand decisions about their money over to a professional, it’s understandable that the ‘know, like and trust’ factor is very important. Technology can be used to record key customer trends and preferences, as well as understanding exactly how they tend to engage with your brand.

It is perhaps counter-intuitive, but the strategic use of automation actually provides the ability to have deeper personal relationships with your customers. Automations can help you manage those relationships and build trust with your customers by providing the right message, uniquely tailored to them, at the right time, via the right channel.

As an example, if a prospective customer regularly interacts with your brand on a particular social media channel, a private message sent via that channel, personalised to them, and based on interests or preferences they have already expressed, can greatly advance the feeling of a personal relationship with the brand. Digital technology can offer the opportunity for these kinds of interactions and also allow firms to have a more proactive approach, staying one step ahead of the curve when it comes to their customers’ needs, with predictive analytics. This is the case for both individuals (B2B) and institutions (B2C)

The fact that the FCA use Salesforce themselves is a clear indication that the they are an obvious choice for every sub-vertical within the industry.

The move towards digital transformation is an inevitable one for W/A Management firms, so it is simply a case of each organisation finding the right path that works for them and their clients. Firms offering software in the digital transformation space can pave that path and ease organisations into digitisation with as little disruption as possible.

Salesforce is among the leading software packages providing W/A Management customers with a clear path to digital transformation. Offering highly customisable solutions that allow firms to create rich client profiles centring on personal goals and pivotal life events, along with productivity tools, client referral tracking and other personalised services.

While some may still think of Salesforce purely as a sales tool, many of those operating within the financial sector already recognise how well they can meet their needs, providing all the features and functions that W/A Managers and other financial professionals need.

The fact that the FCA uses Salesforce itself is a clear indication that it is an obvious choice for every sub-vertical within the industry.

With features and benefits including real-time analytics, self-service options, automations, compliance, efficiency optimisation and data security, the platform stands out from the crowd and must not be overlooked. Salesforce technology gives firms a 360-degree view of each customer, allowing their experiences to be transformed, by firmly placing customer needs and preferences at the heart of every interaction.

Whilst some W/A management companies have been slow to move towards digital transformation, there are a number of benefits that are pushing the industry in that direction, and little doubt that those who adapt fastest will gain a valuable competitive advantage.

Whether automation is used to manage entire process or to assist with building trust with your customers, it’s time to take a close look at the possibilities. As a wealth management professional, it is vital to assess how best to implement your digital transformation in order to become more efficient and streamlined while better serving your demanding and discerning customer base.

©2024 AdaptIQ. All rights reserved.

4th Floor, 18 St. Cross Street, London EC1N 8UN

The Innovation Centre Medway Maidstone Road Chatham ME5 9FD

99B, Westchester Drive

Churton Park

Wellington

New Zealand

6037

No 281, 3rd floor,

Arima Wakefield,

Avinashi Road,

Peelamedu,

Coimbatore,

Tamil Nadu,

641004

308, Brigade Rubix Building,

HMT Main road,

Jalahalli,

Bangalore,

Karnataka,

560021

Company Number: 11929510 VAT Number: 323 2650 34